how to reduce taxable income for high earners australia

Take Home Rates for an annual income of 400000. Both health spending accounts and.

How Do High Income Earners Reduce Taxes Australia Ictsd Org

Business owners and investors have flexibility wage earners not so much.

. Make sure that all of the deductions you are allowed are maximized. Australians are using trust funds to minimise their taxable income to the tune of 35 billion a year according to a new report from the Australia Institute which found those who contribute the. The only way to avoid paying the surcharge is to have private health insurance or private patient hospital cover.

3Reduce Capital Gains Tax CGT Liability. All Australian tax residents must pay a 2 Medicare Levy on top of the taxable income tax. Tax-deferred investment vehicles arent the same as tax-exempt such as a Roth IRA or HSA accounts.

One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. Broadly this provision applies if the sole or dominant purpose of a participant acting in a scheme is to avoid or reduce tax. There is a very powerful general anti-avoidance provision in Australian income tax law known as PART IVA.

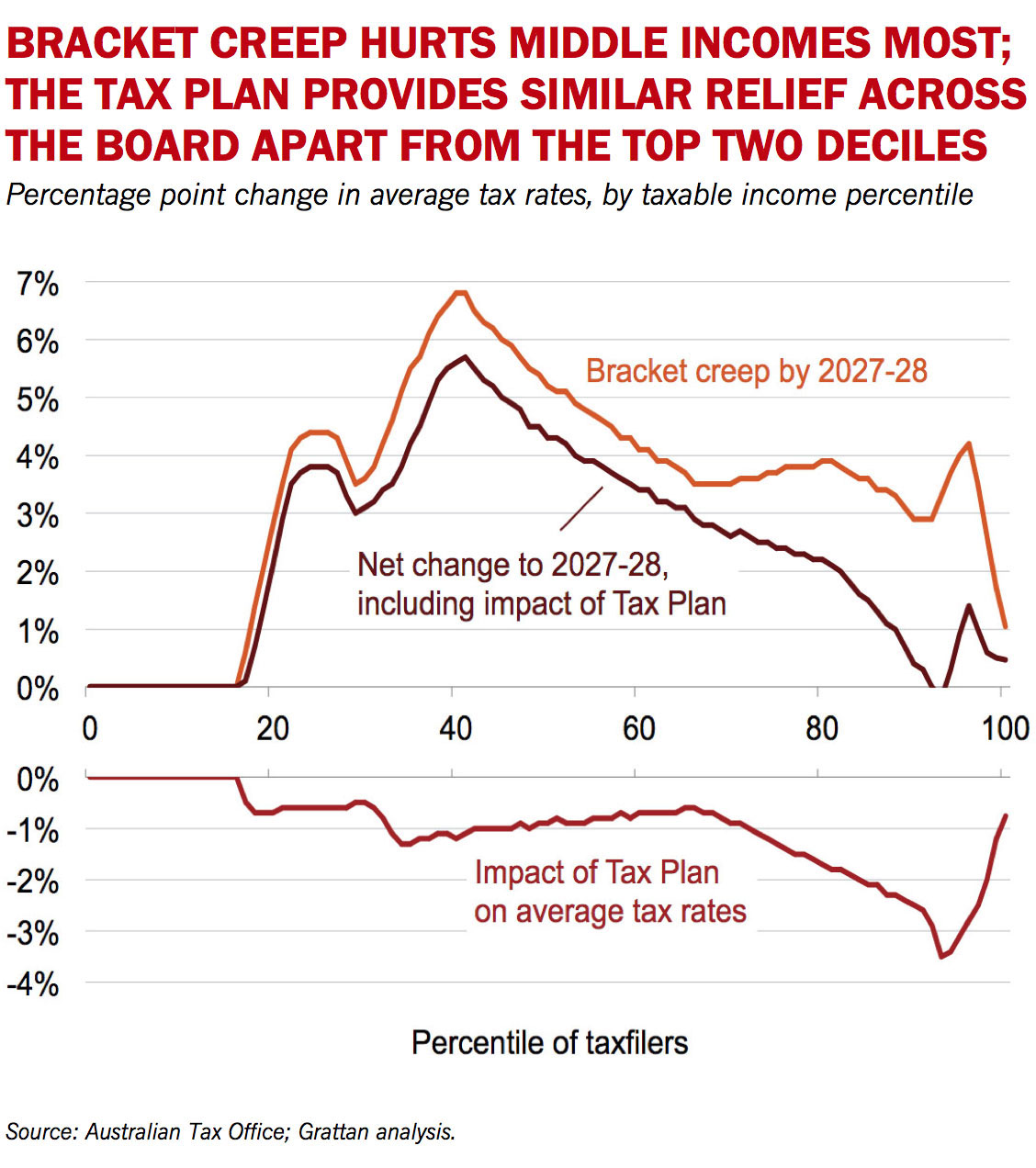

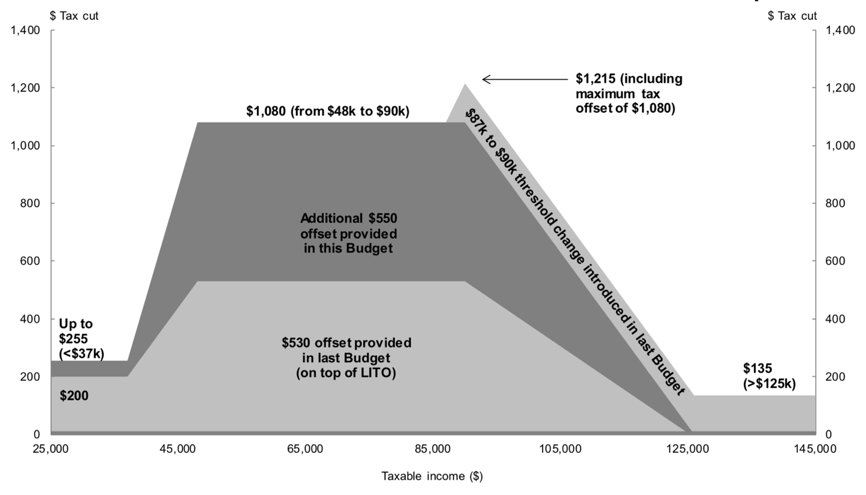

How Do High Income Earners Reduce Taxes Australia. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. A common offset is the Low Income Tax Offset and the Low and Middle Income Tax Offset.

Tax deduction versus tax offset. Most of our Sydney clients are in the top 15 of earners in Australia. If you can manage your taxable income by fully maximising your tax deductions or deferring income.

For example in 2020 we plan to deduct all of the following from our taxable income. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Income protection insurance should also be considered for people who earn a salary over 180000 as the premiums are tax deductible.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Dont fuck around with 6 digit debt get it into 7 digits. According to Australian government statistics Australian men earned 55829 in taxable income in 2018-19 whereas women made 40547.

High Income Financial Planning Reduce Tax and Build Wealth. Maximising your tax offsets. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. The commissioner of taxation can then cancel the relevant tax benefit. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA.

Most of our sydney clients are in the top 15 of earners in australia. - Debt recycle - Maximise Super - Non deductible debt PPOR mortgage sucks balls for high earners. Illegal ways to reduce taxes.

Tax offsets also called tax rebates are effectively tax credits that you can use to reduce the amount of tax would otherwise be due to pay. Invest in an effective tax return for capital gains. Actual high salary earners have limited options really.

For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. Among the top 10 high-income earners surgeons lawyers CEOs and miners took the greatest pay checks. The basics are just.

In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. At some point there will be tax consequences associated with the distribution of the assets. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket.

AAP revealed a vast difference in earnings among women and men of a certain age. Tax strategies for high income earners australia. Maximizing your tax offsets involves doing some research.

The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates. - Borrow to invest and go large. The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

Most of our sydney clients are in the top 15 of earners in australia. Because of the way Australias income tax system is structured moving. The Low Income Tax Offset and Middle Income Tax Offset are the common offsets.

For taxable income levels between 180000 and 273000 the tax saving will be 34. High-income earners must also pay a Medicare Levy Surcharge. If the taxable income can be managed by completely maximizing tax deductions or deferring income to the future year then you will be eligible for tax offsets to 1080 for reducing tax liability.

How Do High Income Earners Reduce Taxes Australia Ictsd Org

How To Save Tax On Salary In Australia Ictsd Org

Gendered Taxes The Interaction Of Tax Policy With Gender Equality In Imf Working Papers Volume 2022 Issue 026 2022

How Do High Income Earners Reduce Taxes Australia Ictsd Org

Republic Of Armenia In Imf Staff Country Reports Volume 2019 Issue 031 2019

How Do High Income Earners Reduce Taxes Australia Ictsd Org

How Do High Income Earners Reduce Taxes Australia Ictsd Org

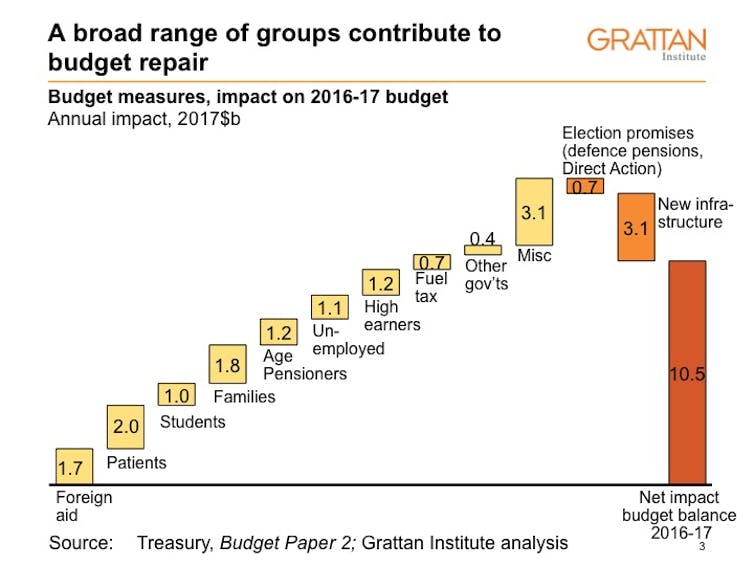

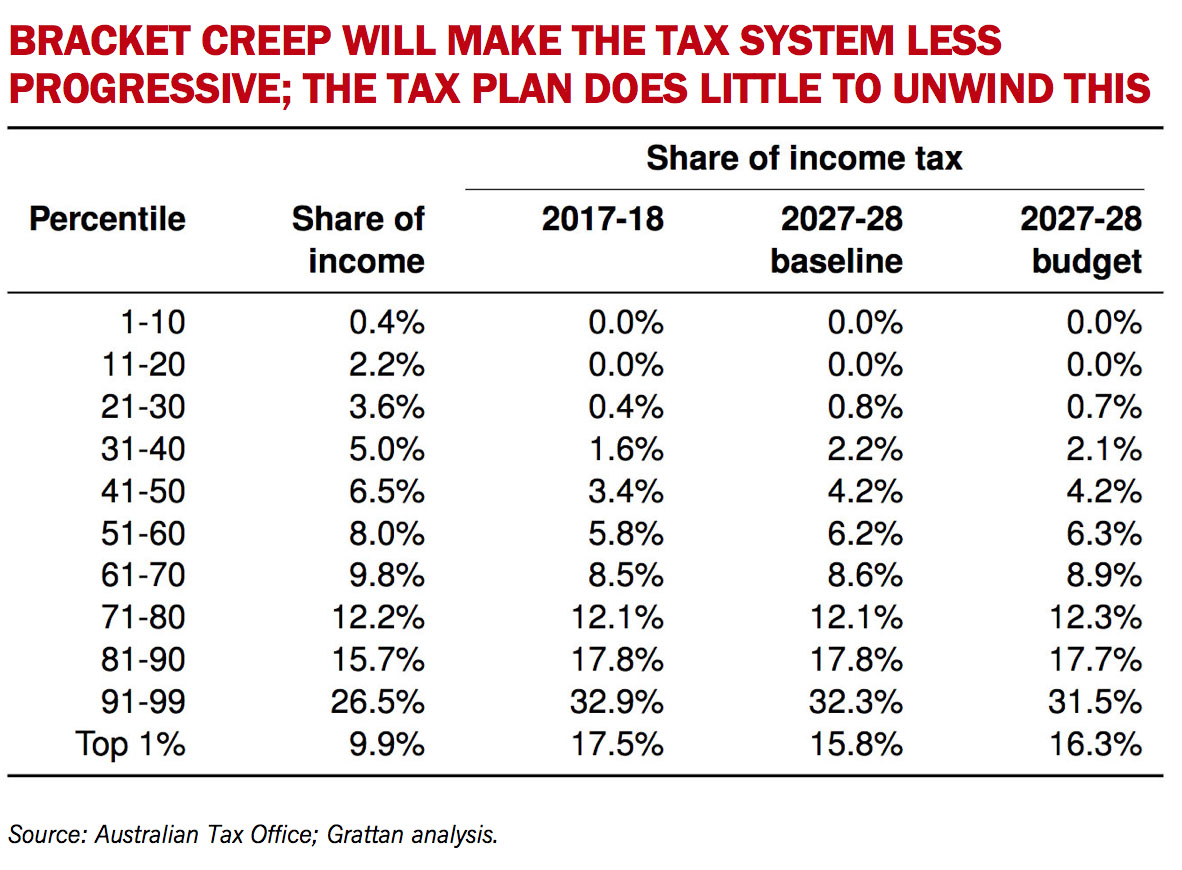

Four Myths About Income Tax Grattan Institute

How Do High Income Earners Reduce Taxes Australia Ictsd Org

Chapter 3 Parliament Of Australia

Budget Forum 2019 Targeted Tax Relief Makes The Tax System Fairer But The Economy Poorer Austaxpolicy The Tax And Transfer Policy Blog

7 Ways To Reduce Taxable Income For Individuals Kns Accountants

Changes Help The Budget But Not The Economy

Four Myths About Income Tax Grattan Institute

How To Reduce The Amount Of Tax You Pay In Australia News Com Au Australia S Leading News Site

How Do High Income Earners Reduce Taxes Australia Ictsd Org

How Do Fiscal And Labor Policies In France Affect Inequality In Imf Working Papers Volume 2016 Issue 041 2016